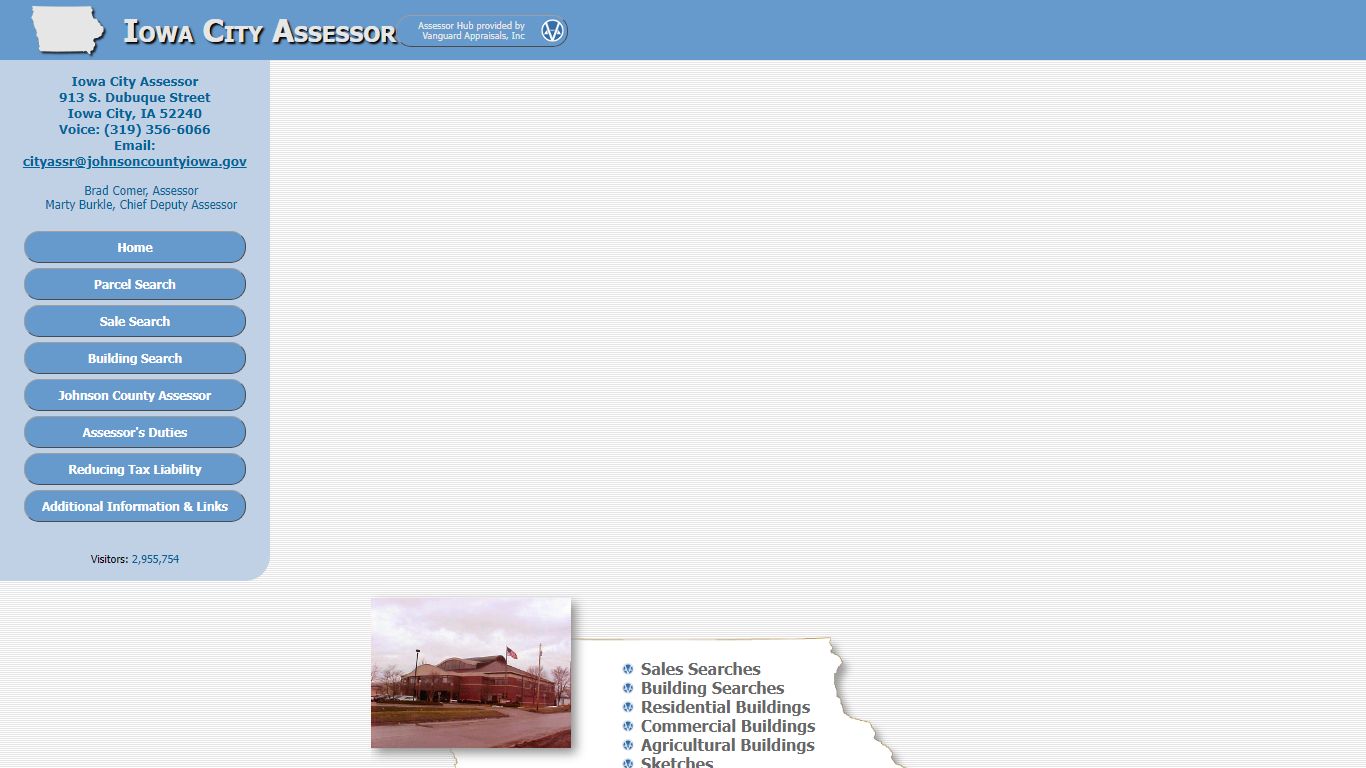

Iowa City Assessor

Iowa City - Iowa Assessors

Iowa City Assessor. 913 S. Dubuque Street. Iowa City, IA 52240. Voice: (319) 356-6066. Email: [email protected]. Brad Comer, Assessor. Marty Burkle, Chief Deputy Assessor. Home Parcel Search Sale Search Building Search Johnson County Assessor Assessor's Duties Reducing Tax Liability Additional Information & Links. Visitors: 2,951,520.

https://iowacity.iowaassessors.com/

Iowa City Assessor | Johnson County

Iowa City Assessor. Home; Content and news related to the Iowa City Assessor office. ...

https://johnsoncountyiowa.gov/department/iowa-city-assessor

County Assessor - Johnson County Iowa

Johnson County Administration Building. 913 S Dubuque Street. Suite 205. Iowa City, IA 52240. Message Us. [email protected]. The County Assessor assesses all residential, commercial, industrial and agricultural properties. Real property is revalued every two years. The County Assessor's office currently has a four-person appraisal ...

https://johnsoncountyiowa.gov/department-of-county-assessor

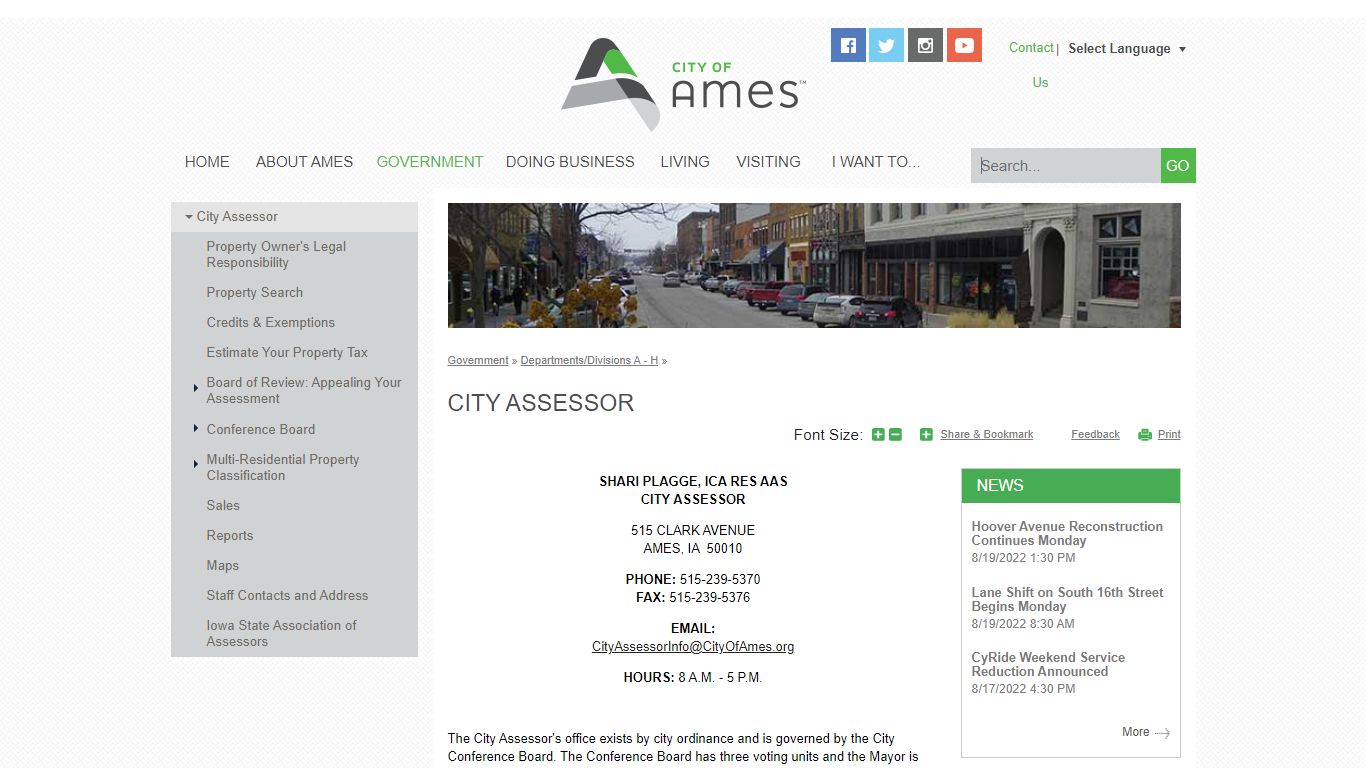

City Assessor | City of Ames, IA

CITY ASSESSOR. 515 CLARK AVENUE AMES, IA 50010. PHONE: 515-239-5370 FAX: 515-239-5376. EMAIL: [email protected]. HOURS: 8 A.M. - 5 P.M. The City Assessor's office exists by city ordinance and is governed by the City Conference Board. The Conference Board has three voting units and the Mayor is the chairperson:

https://www.cityofames.org/government/departments-divisions-a-h/city-assessor

Assessor - Buena Vista County

Iowa law provides for a number of exemptions and credits, including homestead credit and military exemption. It is the property owner’s responsibility to apply for these as provided by law at the Assessor’s office in their jurisdiction. ... The conference board for the city assessor is comprised of the county supervisors, city council ...

https://buenavistacounty.iowa.gov/departments/assessor/

County Assessor - Polk County Iowa

The assessor is charged with several administrative and statutory duties; however, the primary duty and responsibility is to cause to be assessed all real property within his/her jurisdiction except that which is otherwise provided by law. ... Des Moines, IA 50309 Mon - Fri: 7:00am - 5:00pm Phone (515) 286-3014 Fax (515) 286-3386 polkweb@assess ...

https://www.polkcountyiowa.gov/county-assessor/

City of Iowa City | A UNESCO City of Literature

The City of Iowa City is working with local, county, state, and federal partners to keep our community informed about Coronavirus (COVID-19). Click the link for information and resources to slow the spread of this respiratory disease.

https://www.icgov.org/

Cedar Rapids City - Iowa Assessors

Cedar Rapids City Assessor Cedar Rapids City Assessor Iowa Assessor Hub provided by Vanguard Appraisals, Inc Top. 500 15th Ave SW Cedar Rapids, IA 52404 Voice: (319) 286-5888 Fax: (319) 286-5880 Email: [email protected]. Julie Carson, Assessor. Home Real Estate Search Sale Search Building ...

https://cedarrapids.iowaassessors.com/

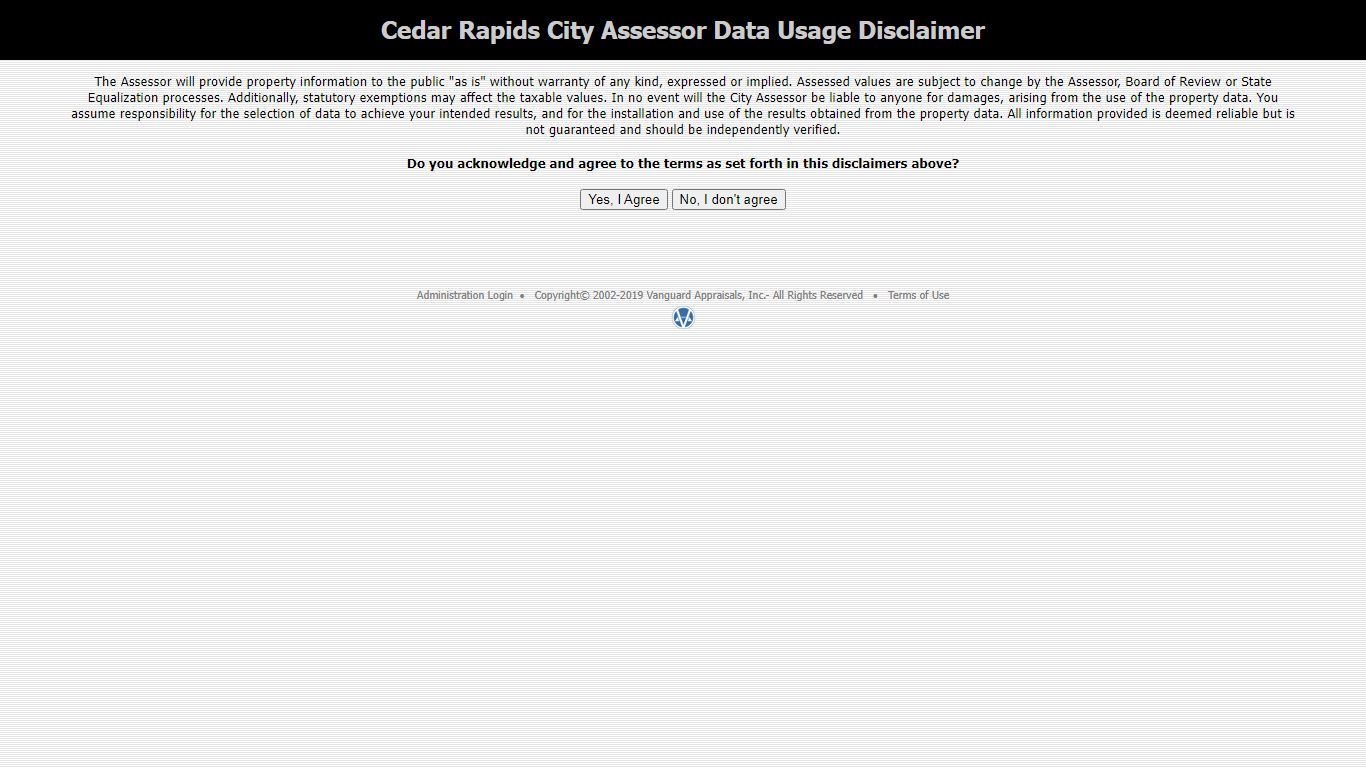

Cedar Rapids City Assessor Data Usage Disclaimer

The Assessor will provide property information to the public "as is" without warranty of any kind, expressed or implied. Assessed values are subject to change by the Assessor, Board of Review or State Equalization processes. Additionally, statutory exemptions may affect the taxable values. In no event will the City Assessor be liable to anyone ...

https://cedarrapids.iowaassessors.com/search.php